ca 2024 sdi limit irs – The Internal Revenue Service (IRS) has recently unveiled the anticipated changes to investor contribution limits for various retirement accounts in 2024, signaling a significant impact on . California tax rates are up again, this time to 14.4%, while capital gains are taxed at 13.3%. The new 14.4% rate is on earnings, while all else is taxed at 13.3%. .

ca 2024 sdi limit irs

Source : www.newfront.com

Health Insurance Income Limits 2024 to receive CoveredCA subsidy

Source : insurancecenterhelpline.com

2024 Social Security, CA SDI Taxable Wage Base, Withholding Rates

Source : hrwatchdog.calchamber.com

The Vita Blog | Vita Companies

Source : www.vitacompanies.com

IRS Announces 2024 Mileage Rates HRWatchdog

Source : hrwatchdog.calchamber.com

Changes to California SDI Coming January 1

Source : www.payroll.org

2024 HSA, FSA, Retirement Plan Contribution Limits Announced

Source : hrwatchdog.calchamber.com

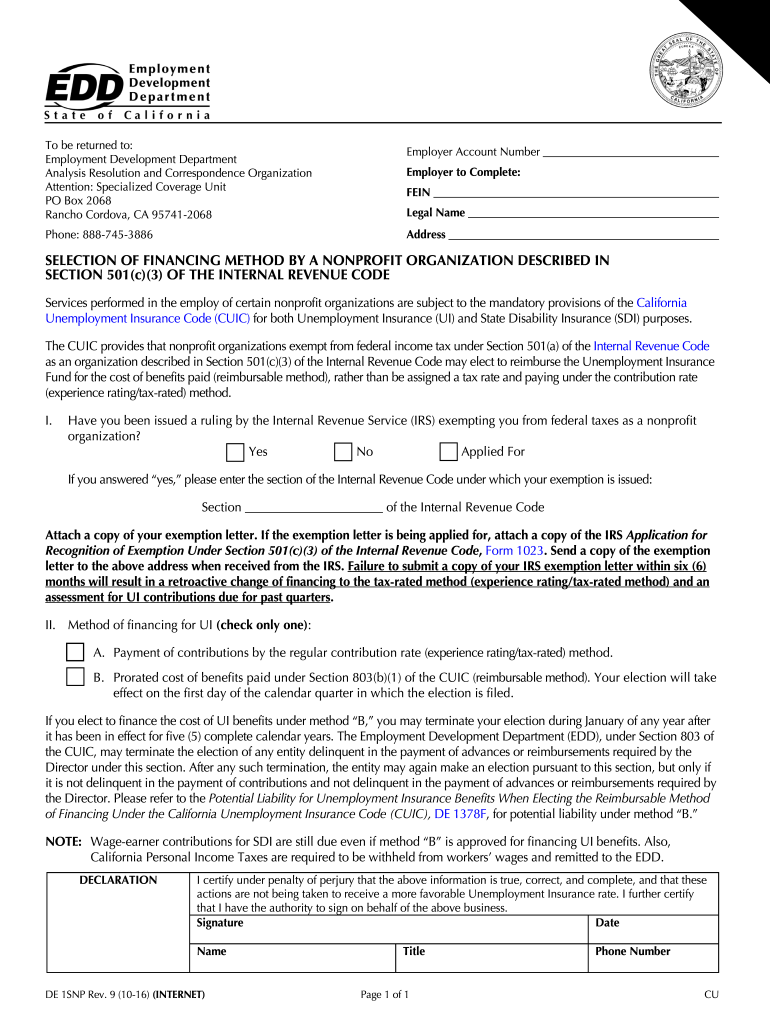

2016 2024 Form CA DE 1SNP Fill Online, Printable, Fillable, Blank

Source : de-1snp-form.pdffiller.com

Compensation HRWatchdog

Source : hrwatchdog.calchamber.com

Misty Epperson on LinkedIn: 2024 Social Security, CA SDI Taxable

Source : www.linkedin.com

ca 2024 sdi limit irs California SDI Payroll Tax Cap Eliminated in 2024: The IRS has announced the dollar amounts that employers will need to know in order to administer their benefit plans for 2024, including the key dollar amounts for retirement plans and individual . Other tax inflation adjustments include the mileage rate increase and higher contribution limits for tax-deferred retirement plans. The IRS has adjusted the tax brackets for the 2024 tax year. .

-1fdab78.png)